Key Takeaways

- A recent Aperion Cares survey found that one third of Millennials thought they could live off $200,000 in retirement.

- AARP says today, you need about $1.18 million to live off $40,000 a year in retirement.

- While it may seem daunting, getting to $1.18 million by the time you retire is not hard considering there’s compound interest that helps get you there.

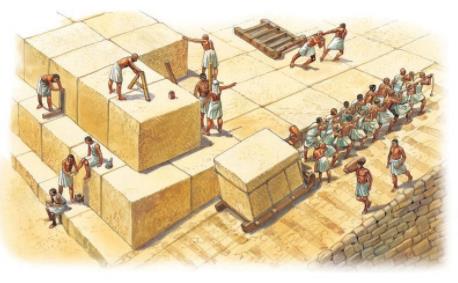

If you go back about four millennia to ancient Egypt, and maybe you are one of the slaves working on the pyramids, you might see that first stone being put in place and say to your buddy, “Hey, I think in a year or two we’ll have this finished.” Well, it actually took 30 years to complete!

I thought of this because of a recent study done by Aperion Care that surveyed 2,000 young people about how much money they thought they needed to retire. About one third of them said they thought they needed $200,000.

That’s not a lot of money!

Well, AARP said, “Look, you need about $1.18 million to get $40,000 a year.” That’s a pretty big difference. It’s not going to take two years, it’s going to take 30.

Now, unlike the Egyptian slave, you don’t have to do all this hard labor, you can let compound interest do it for you. So, let’s say you put $10,000 in to a 401(k), you’re going out 30 years, and it makes 7%. You may remember the rule of 72 that I’ve mentioned before, where if you divide an interest rate into 72, it tells you the number of years that something will double. So, 7 goes in to 72 abut 10 times, so that’s about 10 years.

The money doubles every 10 years, so $10,000 grows to $20,000 in 10 years, up to $40,000 after 20 years, and $80,000 after 30 years.

That’s quite a bit, and that’s without even adding any money.

That $1.18 million number doesn’t look so daunting when you realize you can add several of those $10,000s over the years to get there. In fact, you’ll get well beyond that $1.18 million.

But with $200,000, unless you live in a tiny house, have a tiny appetite, and really, tiny everything, there is no way you are going to be able to live without having to rely on other people for support because there just won’t be enough money to go around.

The next time you are looking at accumulating your money, just think of it as starting the base of your pyramid. It will grow over time with compound interest, and you’ll be able to make your goal. So hopefully when you are living in to your golden years, you aren’t living in a tiny house.

Until next time, enjoy!