What is a Power of Attorney?

Key Takeaways Powers of attorney allow other people to act on your behalf. You can grant power of attorney for a variety of reasons. You’ll

Key Takeaways Powers of attorney allow other people to act on your behalf. You can grant power of attorney for a variety of reasons. You’ll

Key Takeaways Money is a common source of arguments for many couples. Whether you combine all, some, or none of your money doesn’t really matter.

Key Takeaways Most people are familiar with savings and checking accounts, but may not be as familiar with brokerage accounts. Brokerage accounts hold various assets,

Key Takeaways Understanding how money works isn’t intuitive. Children can start learning from a young age how money works, but they need hands-on experience to

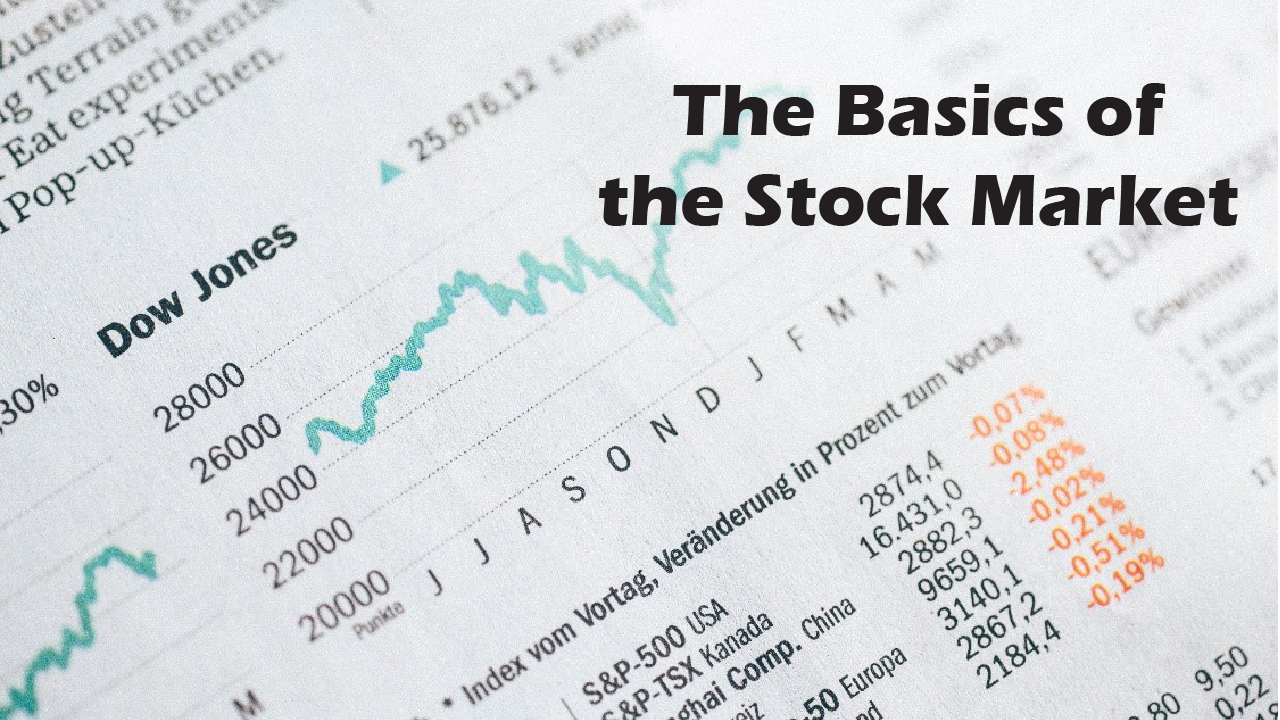

Key Takeaways The stock market is an intangible thing that can be a bit difficult to understand. There are a lot of factors that affect

Key Takeaways The three credit reporting agencies set the rules for how your credit score is calculated. A good credit score is over 740, so

Key Takeaways Defined benefit plans and defined contribution plans are both retirement plans. These plans have some key differences, though. Defined contribution plans have been

Key Takeaways For those who work in the service industry, the top priority is helping clients or customers. The Strategic Coach® Program’sO.S.®, is a smart

Key Takeaways We tend to have the wrong ideas about what makes us happy. It may seem counter-intuitive, but the current pandemic may help us

Key Takeaways Financial stress, physical health, and mental health are all linked. If you’re experiencing chronic stress, you may end up in a vicious cycle