Key Takeaways

- Life insurance is important to have if you have dependents and are a high income earner.

- Term insurance and Cash value insurance are the two types of life insurance.

- There are different benefits to each type of life insurance, so it’s important to know the advantages and disadvantages of each to determine what fits for you and your family.

Life insurance is like needing a parachute: If it isn’t there the first time, chances are, you won’t be needing it again. It’s a sobering thought, but it’s important to understand how that makes a huge difference in your dependent’s life.

If you are single, and you don’t have any dependents, you probably don’t need much, if any, life insurance. However, if you have dependents, you are going to need that coverage, especially if you are a high income earner in the family.

How much life insurance do you need? If you are younger, 20 to 30 times your income. Yes, that’s a lot. If you are making $50,000 a year, that’s a million to a million and a half. You still must go through the underwriting process first to make sure you medically qualify. If you don’t qualify, you may be denied coverage or have a higher premium payment. If you do qualify, then you have two kinds of insurance to look at: term insurance, and cash value insurance.

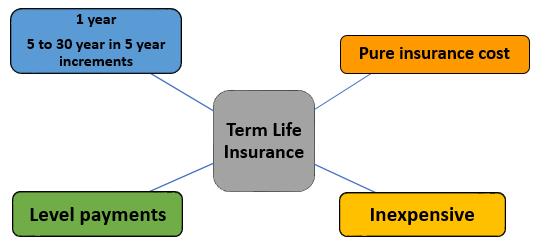

Term insurance:

- Comes in 1 year, or 5 year to 30 year payments in 5 year increments

- Pure insurance cost – if you don’t die during the term, the policy pays nothing

- Level premium payments

- Rather inexpensive

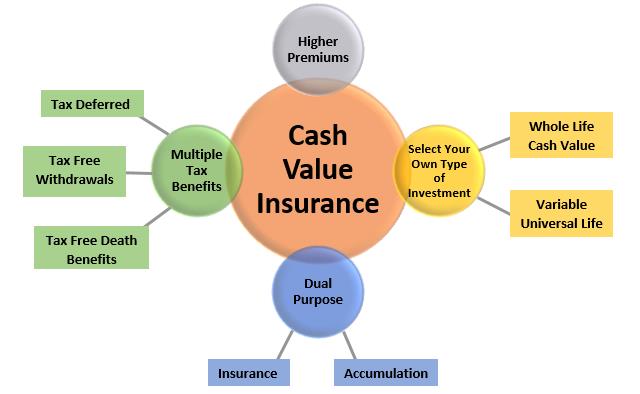

Cash Value Insurance:

- For life insurance coverage AND accumulation

- Higher premium payments

- Tax benefits – it’s tax deferred, tax free withdrawals, tax free death benefits

- You pick the kind of investment – you could go with a Whole life cash value traditional policy, which is guaranteed by the insurance company, or go all the way to Variable universal life insurance, where you select the mutual fund type investment that you invest in, in stock and bond markets.

Whichever life insurance you choose, it’s important for income earners with dependents to ensure there’s money available to protect the wealth that’s already accumulated, and to protect family members through the long term to make certain they have good lives down the line.

Until next time, enjoy!

Gary