Key Takeaways

- If you work in the gig economy, you are considered self-employed.

- As a self-employed person, you have to pay estimated taxes quarterly, or you face penalties and you are charged interest.

- If you worked for an employer, they would take Social Security and Medicare from your paycheck as well as pay the IRS themselves, but as a self-employed person, you pay both sides and that can get expensive.

I really love the song “Tax Man” by the Beatles, it has a great beat. I remember listening to it as a kid and thinking, “Wow, this is kind of cool.” When I became an adult however, I realized, “No, this is not cool at all!” The song did a good job of pointing out that the tax man is going to get their money!

If you’re in the gig economy, perhaps driving for Uber or freelance writing or something, and you are earning dollars outside of maybe your main employment, then you are considered a self-employed individual. The IRS treats you just like they treat your employer. Your employer collects Social Security and Medicare from you, but they also pay the IRS. So, as a self-employed person, you get the privilege of paying both sides to the IRS through estimated taxes payed on a quarterly basis.

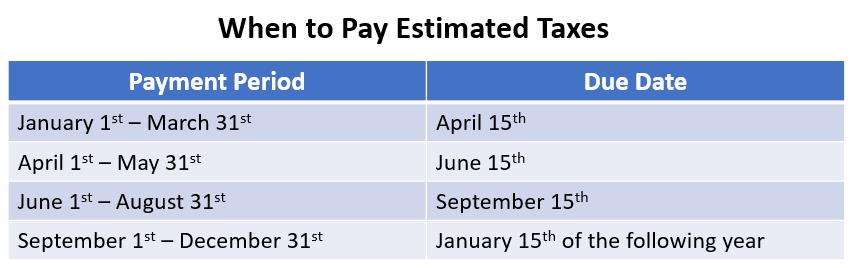

Now, you may think that sounds unfair. Maybe it is, maybe it isn’t, but if you don’t pay your estimated taxes, the IRS is ok with that. They just penalize you and charge you interest! So, you want to ensure you pay your estimated taxes. As I mentioned, you pay these on a quarterly basis, first on April 15, and then three more times: June 15, September 15, and January 15 of the following year.

It’s important to realize that these taxes can be expensive. If you earn $1,000, you must pay 7.65% for Social Security and Medicare, then you have to pay the other side as well, though you do get a deduction. That ends up putting you around 12%. That’s not even including federal taxes and state income tax, if you live in a state that has that.

Since estimated taxes can already be expensive for you, be sure to get your quarterly estimates in on time throughout the year so you don’t end up having any penalties and paying more money in interest to the government. The tax man is going to get what he’s owed either way, so make sure you don’t end up giving him any more than you have to!

Until next time, enjoy!

Gary