Key Takeaways

- There’s a big difference in what the Millennial generation expects in terms of returns on investment in the stock market versus what their parents, the Boomer generation, expect.

- Going back over 100 years, the return on investment in the stock market is about 10%.

- There are three things to keep in mind when investing in the stock market: Long-term perspective, diversification, and discipline.

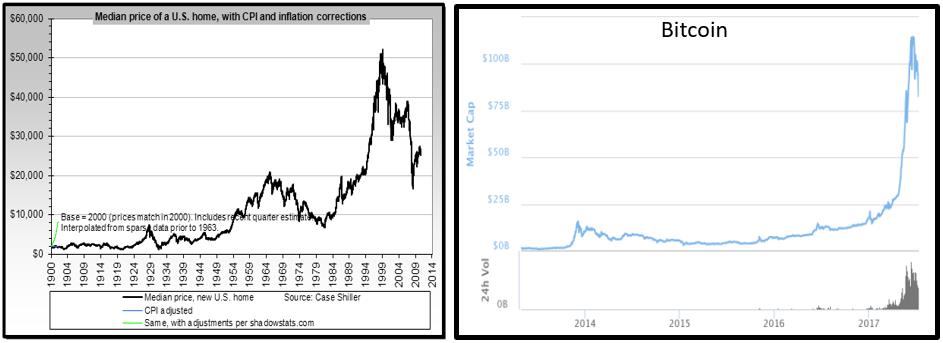

Real estate goes up, and cryptocurrencies, they always go up too. Well, not exactly. Up until 2007, everybody thought real estate would go up, but it actually crashed. In fact, the market still hasn’t returned to pre-2007 levels. And cryptocurrencies, they went up for a while, and then they too crashed in January 2018. Is this also true for the stock market?

No, not quite. A recent study by AMG that surveyed people aged 17 to 70, found that millennials believed the stock market’s return rate is 13.7% going forward, and their parents, the Boomer generation, believe it’s 7.7% going forward. However, if you go back over about 100 years, it’s actually around 10%.

So, what’s going on with the higher and lower expectations gap between the generations? I am not sure because there’s some psychology at play here as well. What I do know is that there are three rules to keep in mind when investing in the stock market:

- Long-term. If you are going to invest in the stock market, it has to be a long-term perspective. You want to hold that position or positions in equities and stocks for typically five years, and most likely for longer than that if you are talking about a 401(k) for retirement purposes.

- Diversify. You want to diversify your stock positions because some go down, and some go up over time. As a recent example, retailers, because of Amazon, have gone down around 50% in the last couple of years, but Amazon and other tech companies have been up double that over the same timeframe. You also want to diversify across different categories, both domestic and international, as well as big stocks and small stocks. This will ensure you don’t get hit hard when a stock goes down because you made sure not to put all your eggs in one basket.

- Discipline. You don’t want to constantly change the way you operate. For example, perhaps you have everything in index funds, then you decide to invest in individual managers and do derivatives or something else in the stock market, then later you decide to do something else. You want to be consistent and have the discipline to stick with it.

The bottom line is this: If you are going to invest in the stock market, it’s basically 10% long-term return, you need to diversify your investments, and have the discipline to stick with a plan, give it a long-term perspective.

Until next time, enjoy!

Gary