Key Takeaways

- Many partnered millennials are shockingly unaware of how they use money and even how much money their spouses make.

- The problem with millennials and money likely comes from their upbringing and the perception that it’s a taboo topic.

- Not talking about money can lead to financial chaos and broken relationships.

- Mindful communication about money and where you (as a couple) are going with it can strengthen your relationship and relieve the effects of financial chaos.

Remember when you got married and you opened up all those envelopes with all that money? It was so cool. All that cash and all those checks — so cool.

Well, after I go through this information based on a recent survey about couples and money by Fidelity Investments, you might realize that’s the last time you even talked about money with your spouse — or even counted what you have.

Here’s what the survey said:

- One third of millennials are unaware of how much money their spouse made. A third. Think on that for a minute.

- One seventh didn’t even know if their spouse was employed. That’s interesting.

- Forty percent are unable to agree on when they should retire.

- Over 50% of millennial couples don’t agree on how much money they need for retirement.

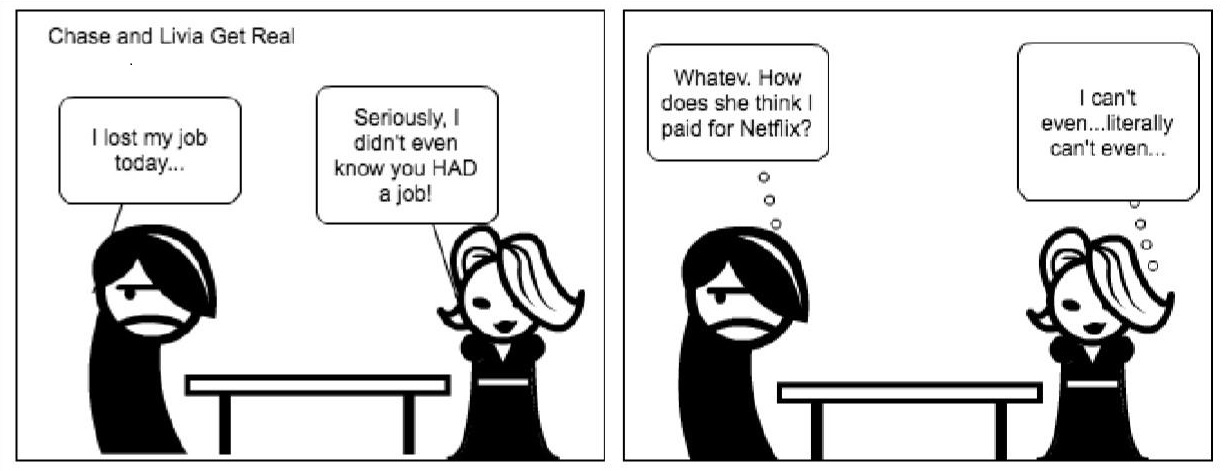

That’s a lot of not agreeing and not knowing. I think it all comes down to the perception in our society that money’s a taboo topic: don’t talk about it. The problem with this mindset is that money determines how we live. We have to pay all our bills with it. We have to use it for leisure time and vacations.

If you don’t talk about it, you can find yourself just wandering all over the place and doing all sorts of things that you don’t intend to do. But it just kind of happens. Do you know what also just kind of happens? Spending money that you don’t want to spend and don’t need to spend.

With the fast-paced lifestyle we live today — tethered to our smart devices 24/7 and seeing the world primarily through the lens of that device, we can lose focus on what’s really most important. Seriously though, not even knowing if you spouse is employed? Don’t know what your spouse makes? Not even sure about how much money you need to retire? You’re spending money every single day and no one is talking about it. That’s weird and it doesn’t make a lot of sense.

I think much of it comes from our parental and grandparental upbringing where money was just something you didn’t talk about, or maybe our parents didn’t have healthy relationships with money. Money, and the issues that come with a bad relationship with it, represents one of the top reasons people get divorced. Conversely, we’ve found that successful couples talk a lot and communicate about everything, especially about money. Unexpected things happen — things that can cause turbulent rifts in marriages and lead to real problems in understanding and resolution.

It’s important to form a habit of constant communication. Make a commitment to talk about money once a week, or at least once a month. Discuss where you are financially, where you’re going, how you’re each spending your money, and come to an agreement about this trajectory. I’ve seen people do this in a variety of ways. Some keep separate bank accounts. They make purchases and decisions jointly, but they make it work through communication. Others are more traditional with a shared bank account. The main thing is that couples address their financial situations and communicate intentionally about it.

By communicating and taking deliberate steps to both understand where you are with money, you can avoid being one of those disturbing statistics. Communication will give you a good marriage, healthy relationship with each other and with money, and solid tools to work through any issues that come your way.

Until next time, enjoy.

Gary