Key Takeaways

- Compound interest is a powerful thing.

- If you’re not participating in the stock market, you’re likely missing out on the power of compound interest.

- The recommended guideline of saving 15% of your income for retirement makes the assumption that you’re earning compound interest.

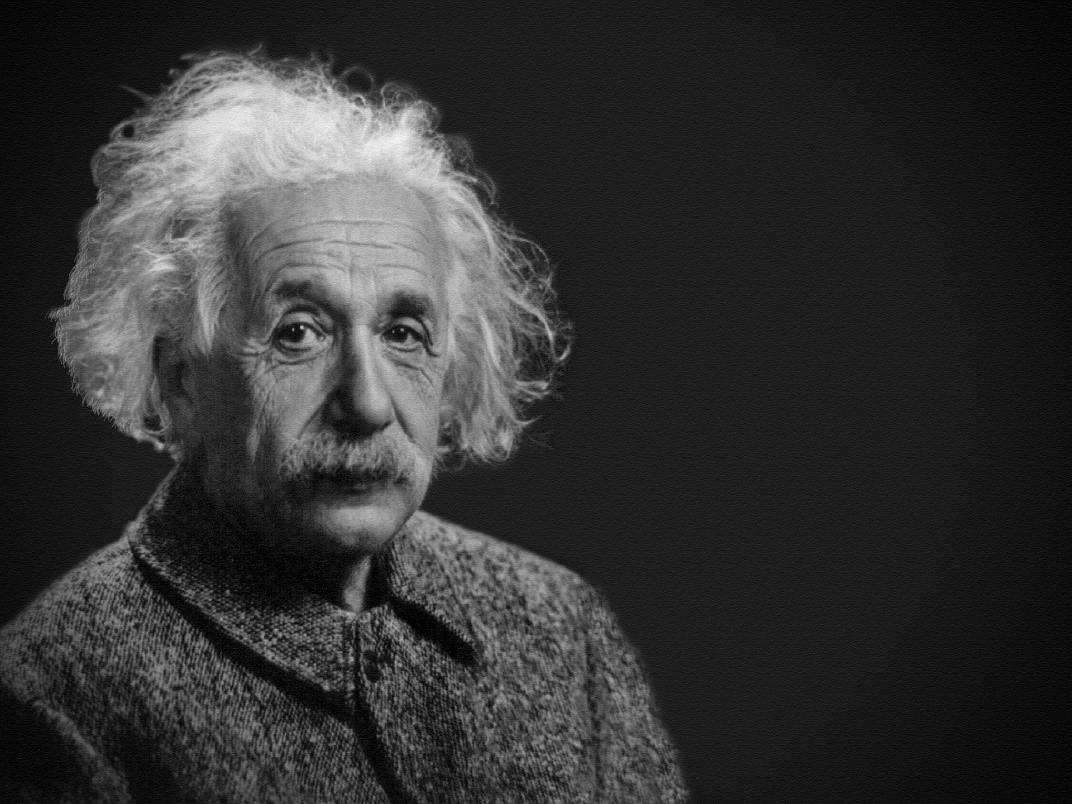

Einstein called compound interest the eighth wonder of the world, stating “He who understands it, earns it; he who doesn’t, pays it.” He called it the most powerful force in the universe, and it’s a good idea to understand why.

A recent MSN article, “If You’re Afraid to Invest in the Stock Market, Do This Calculation to See How Much Money You’re Losing Out On,” cites research by the St. Louis Fed. This research found that 50% of Americans are not participating in the stock market. For millennials, it’s even worse: 60% of millennials have no investments whatsoever related to the U.S. stock market.

It’s important to understand the effects of not investing in the stock market. The recommended guideline for retirement savings is to save roughly 15% of your annual salary. Say you make $50,000 per year; 15% of that is $7,500. If you were to just take this $7,500 and put it into a savings account, making no interest, after 30 years you’d have $225,000.

That’s a fair amount, but let’s examine what would happen if you were to participate in the stock market and allow compound interest to work for you. Assuming a 6% return on your money, over 30 years, that same $7,500 of annual savings would come out to $592,000. That’s huge! That’s more than double what you’d have without interest.

Now, when you hear about that guideline of saving 15%, part of that guideline is the assumption that you’re earning compound interest. You can’t really save and expect to retire unless you participate, at least to some extent, in some kind of equity growth over time: publicly traded markets – the stock market here in the U.S. and overseas.

The point is, be aware of the power of compound interest. Without it, you’ll have to save a lot more than 15%, you’ll have to wait longer to retire, and you’ll be fighting inflation which runs about 3% a year. Einstein knew what he was talking about: let the eighth wonder of the world work in your favor! Until next time, enjoy.

Gary

Copyright © 2019 Protinus. All rights reserved.