Key Takeaways

- Financial self-awareness is a measure of how well you understand your financial situation.

- There are a number of benefits to possessing financial self-awareness.

- You can use The Learning Cycle by The Strategic Coach Program® to help increase your financial self-awareness.

Psychology Today recently published the article, “Four Powerful Benefits of Financial Self-Awareness.” Not to be confused with financial literacy (which entails understanding interest rates, the difference between stocks and bonds, and other basic principles of economics), financial self-awareness is a measure of how well you understand your financial situation.

If you have a high level of financial self-awareness, you’ll have a good grasp of your spending habits, you’ll know what your assets are, and you’ll know what liabilities you have. According to the article, this results in possessing a higher level of financial self-efficacy, paying off more debt, having greater satisfaction with your finances, and seeing better financial outcomes.

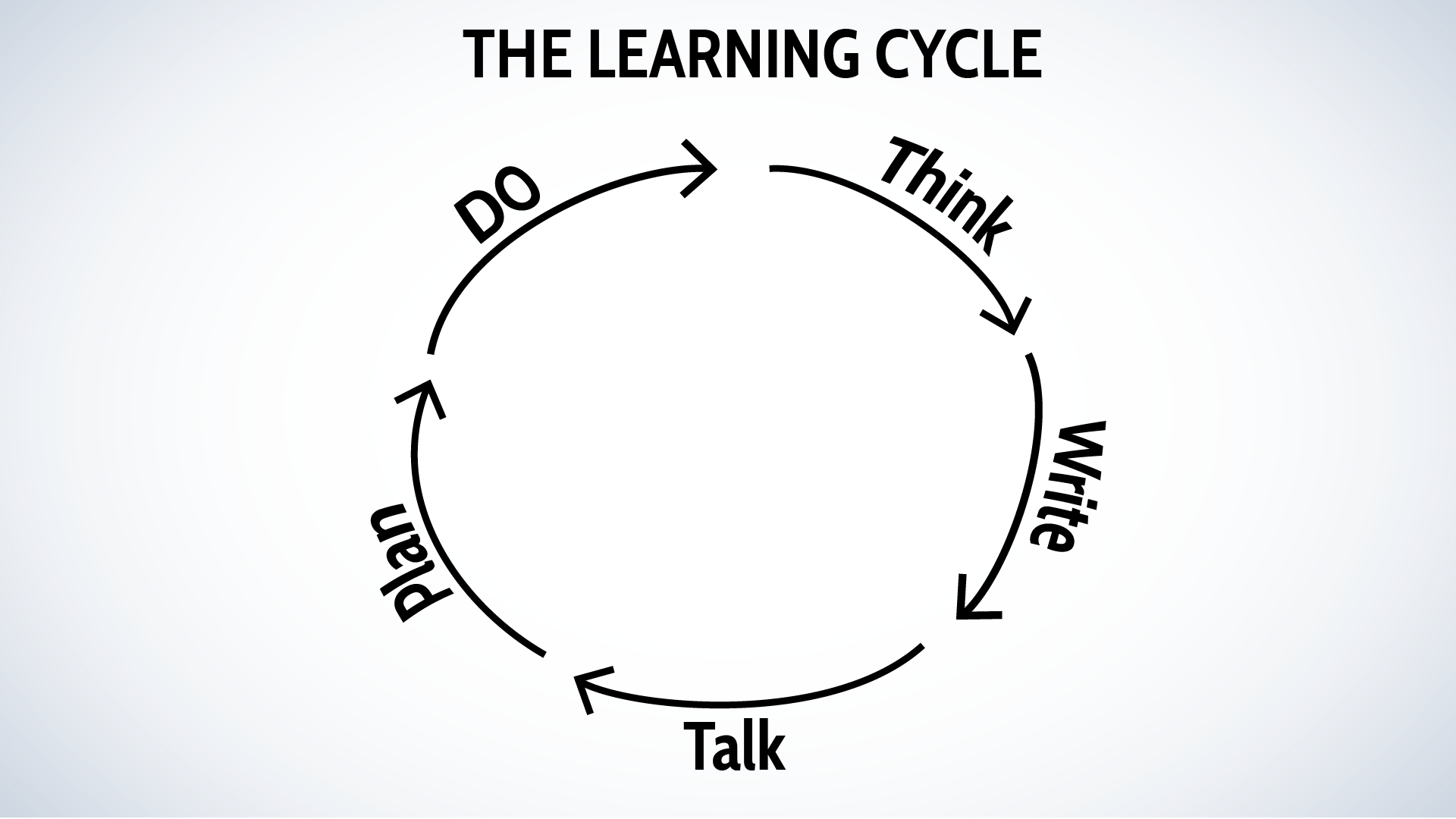

So how does one achieve a higher level of financial self-awareness? Well, one really useful tool you may want to try is The Learning Cycle from The Strategic Coach Program®. It consists of five steps of how to go through learning something new or thinking through something.

The first step is to think. You think through something you’re trying to deal with—in this case, something that’s related to your finances.

The second step is to write. Write down your thoughts on the issue. This helps you process the information in a different way.

The third step is to talk. Talk to another person about the financial matter. Get their feedback, and hear yourself say out loud what the issue is.

The fourth step is to plan. Now that you’ve thought about it, written about it, and talked about it, it’s time to formulate a plan.

Finally, you’ve reached the fifth step, which is taking action and actually doing the thing you’ve focused on.

If you implement this process on a consistent basis and apply it to your financial decisions, it’ll help you achieve a higher level of financial self-awareness. Whether you’re thinking about paying off student loans or credit card debt, or obtaining a mortgage, or creating an investment plan, or any other money decision, you’ll find this to be a helpful process.

For instance, say you’re considering making an expensive purchase. If you refer back to The Learning Cycle, you’ll know to take your time, really think it through, and make a smart decision, rather than impulsively buying it and experiencing buyer’s regret.

Making these smart decisions will give you more and more confidence, ultimately giving you a higher level of financial self-awareness. You can use it for any financial decision, big or small, but the key is to do so consistently, and you’ll find that, over time, all those smart, well-thought-out decisions, will add up in the long run. Until next time, enjoy.