Key Takeaways

- There’s a lot of complicated information out there when it comes to investments.

- One simple piece of information, though, is The Rule of 72.

- Use this rule to calculate when your money will double.

There’s a lot of information out there regarding investments, and some of it can get pretty complicated. However, there’s one that’s pretty simple and can be really helpful when you’re looking at your investments. It’s The Rule of 72, and it’s a way to figure out when your money will double.

This is how it works: you divide an interest rate into 72 to find the number of years it will take for your money to double. For example, if you believe you’ll make 8% on an investment, you’d do the following:

72 ÷ 8 = 9

This would tell you that, at an interest rate of 8%, your investment would double in nine years. So if you had $10,000 to invest and it made 8% in nine years, you’d have $20,000.

Why is this important? Well, when you’re making decisions about putting money in cash, money market accounts, real estate, stocks, and bonds, it makes a big difference down the line. If you’re putting money away for long-term purposes, you’ll really want to know what amount is going to be there, based on what the interest rates are.

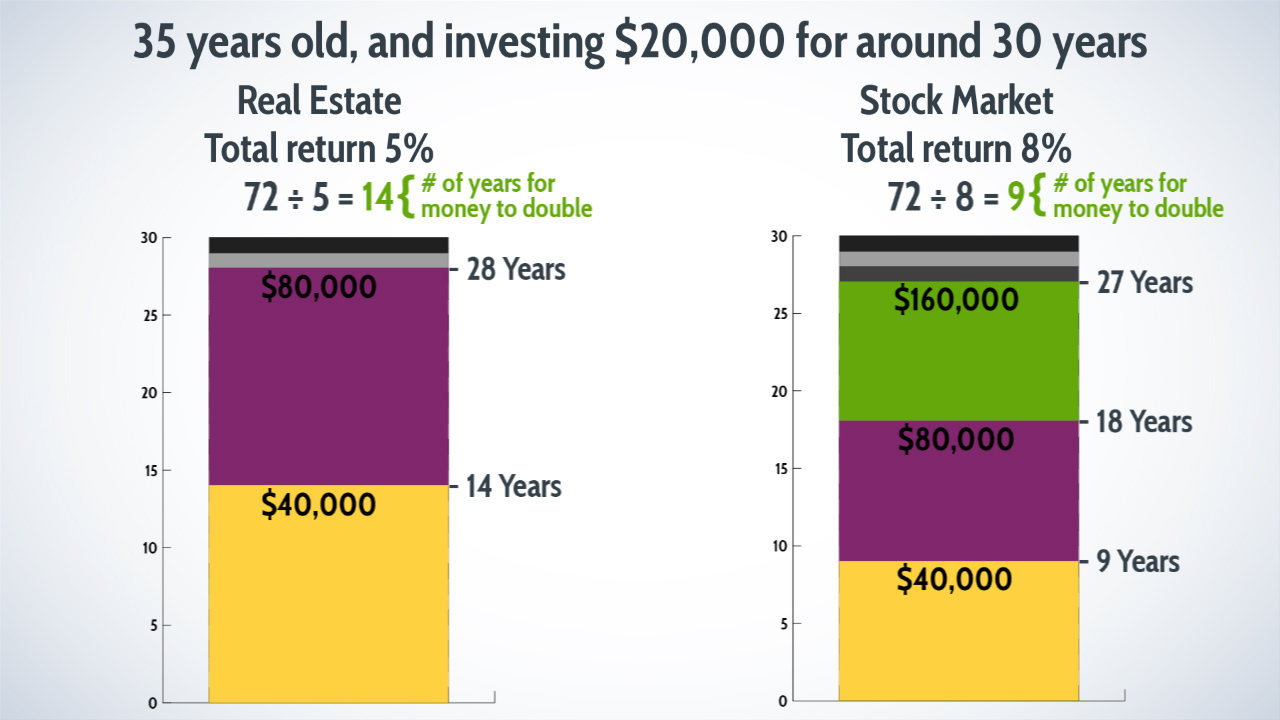

For example, let’s say you’re 35 years old and considering putting $20,000 in real estate versus equities in the stock market, and that you’re investing this for the next 30 years or so. Well, real estate grows at about 3% per year in inflation, and you can probably make another 2% if you are successful in renting the property out. That’s a 5% total return. With the stock market, you can expect about 8% over the long term (and keep in mind that we’re not talking about the short term, because markets go both up and down).

By using The Rule of 72, you’ll find that your $20,000 would double twice in 28 years, resulting in $80,000 when you’re in your mid-60s. Looking at the stock market, though, The Rule of 72 tells you that your money will double three times in 27 years, growing to $160,000. So which would you choose? Well, it’s pretty clear you’d take the bigger pile!

Now, having laid this out, it’s still possible that you’d decide to invest in real estate or some other area, based on other factors, but this is a useful tool that you’ll want to take a look at. It’s pretty simple math, and you don’t want to lack clarity on your decision because you didn’t do the math. Until next time, enjoy.