Key Takeaways

- It’s important to understand your payroll deductions.

- Your withholdings will vary depending on a number of factors.

- Be careful not to over-withhold on taxes.

The only sure things in life are death and taxes, right? Well, given that they’re unavoidable, let’s examine the latter, as it’s important to have an understanding of what’s being withheld from your paycheck.

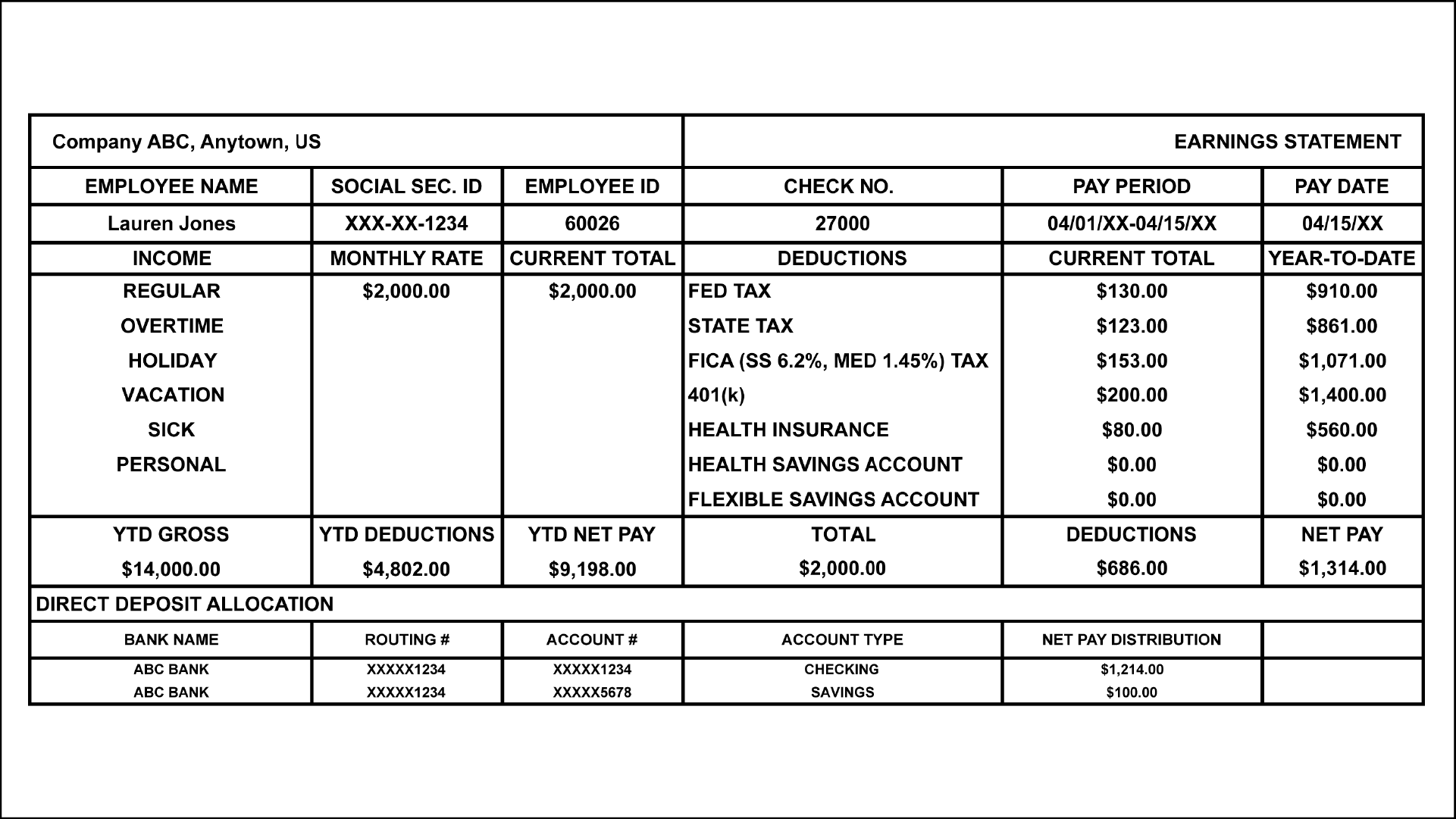

If you’re actively working as an employee, you can look at your pay stubs and see what’s being deducted from your gross pay. Let’s say you are paid twice per month and your gross pay is $2,000. You’ll see that there are mandatory deductions for FICA, which is comprised of two parts: Social Security at 6.2% and Medicare at 1.45%. Next are federal and state taxes, calculated based on a formula that takes into consideration how you completed your W-4 withholdings form.

From there, you may also have some or all of these (or a number of other deductions not listed here):

- 401(k)

- Flexible Spending Account (FSA)

- Health Savings Account (HSA)

- Health insurance premiums

- Disability insurance

- Life insurance

As you can see, there are several possible deductions coming out of your gross pay. You may start at $2,000 and end up with a net amount of $1,500, depending on your withholdings and deductions.

The amount may change year-to-year not only due to your particular situation, but because tax code changes every year. For instance, the child tax credit recently increased significantly, from $2,000 per child up to $3,600 per child, depending on age. If you have four children, you may find that this credit pays all your taxes, meaning you wouldn’t want any withheld.

Additionally, if you receive a bonus, it gets taxed at a higher rate. You may have some control over this, though, by asking Human Resources not to take out the higher rate.

You may be wondering why it’s important to keep tabs on withholding the right amount – it all comes out in the wash anyway, right? If you withhold too much, you’ll just get a refund come tax season. Well, here’s the problem with over-withholding: that money just sits there when it could’ve been working for you from the get-go. Say you receive a $3,000 refund come April 15th. Wouldn’t it have made more sense to put $250 into your 401(k) every month, where it could have started working right away?

It may seem a bit tedious to pay attention to this, but making sure you’re withholding the right amount can make a difference in the long term. It can affect how your money is being invested and where it’s going at various times of the year. So it’s worth that bit of effort to keep tabs on it. Until next time, enjoy.

Gary

If you’d like to read more on this topic, here are a few of Gary’s previous posts that you might enjoy:

Don’t Overwithhold Taxes from Your Paycheck – Build Your 401(k) Instead