Key Takeaways

- It’s important to check in on your finances on a regular basis.

- There are three main areas to examine when you’re doing this.

- If you’re not sure how to start, try using a 30/60/90-day sheet.

Last year, we had a blog post on the Frugal February Challenge. Whether or not you participated, the idea was to get thinking about your finances in the new year. Now that we’re at the end of the first quarter of the year, pause for a moment and take notice of where you are. You can approach this from three different areas:

1. Your balance sheet. These are your assets. If you were planning on putting more money into your 401(k) or saving money for a home or another big purchase, take a look at what you’ve achieved this quarter.

2. Cash flow. This is an area that really impacts us. Do you have a budget? Are you following your budget? If you don’t have one, or aren’t following one, you’ll want to make changes to do so.

If you are following your budget, did you make automatic contributions to your 401(k) or other savings? Are you directly depositing money into savings, so that it’s not going into your easy-access checking account?

There’s also looking at debt. Are you paying it down? Know where you are with credit card debt, auto debt, school debt, and any other loans.

3. Taxes. It may seem like this is an area where you can’t make any changes. That’s not the case. Putting money into your 401(k) will affect your taxes. There’s the adage, “If the government owes me, now’s better than later. If I owe them, later is better than now.” In other words, pay less in taxes. It’s worth it to look into ways that you can save here.

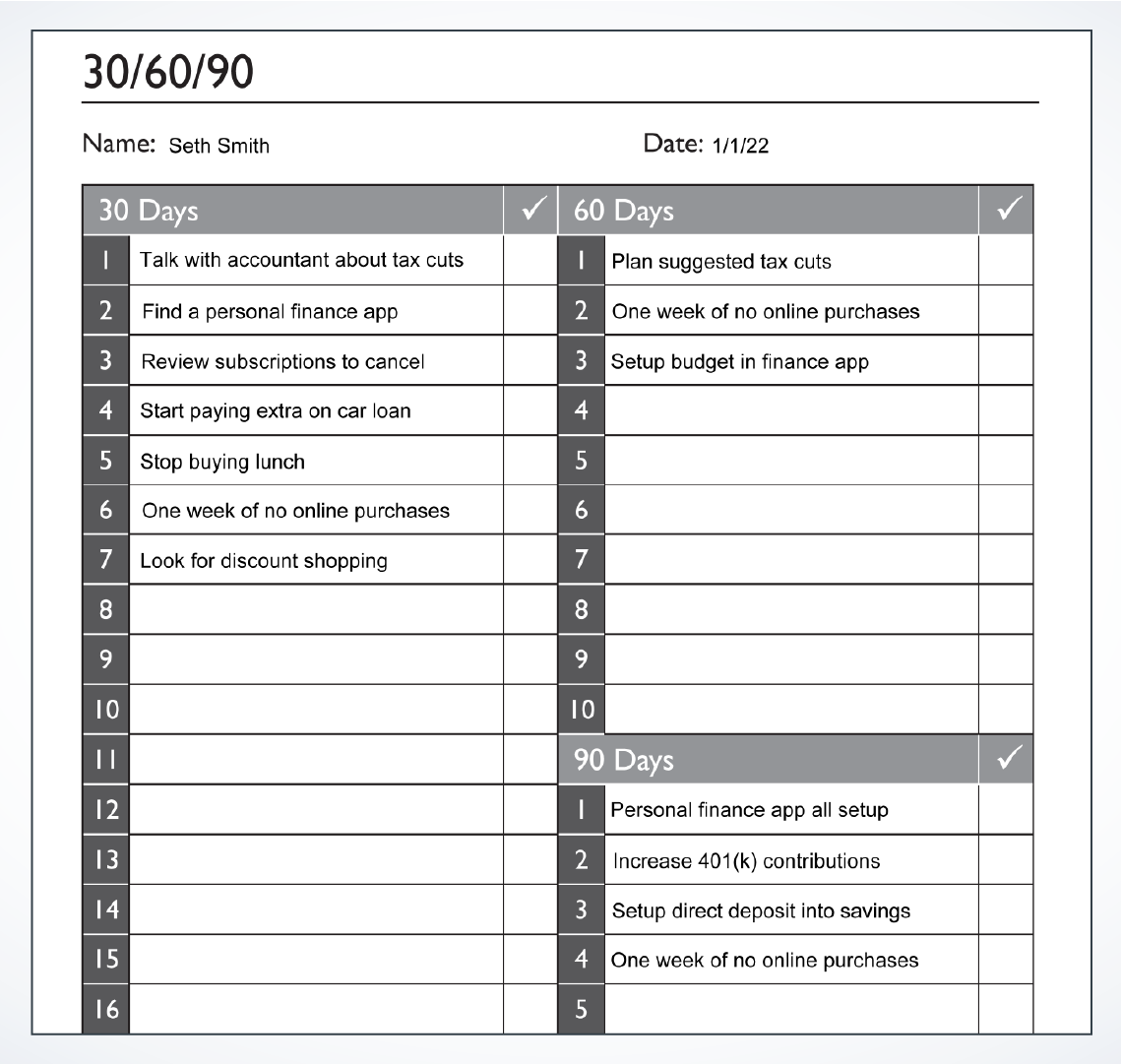

If you’re looking for an easy framework to use for this regular financial check in, try using a 30/60/90-day sheet. Write down your goals and your to-do’s as they relate to the three areas. Ask yourself what you need to do within the next 30 days. Perhaps you want to pay a little more on your car loan or start packing your lunches instead of buying them every day. Then look at the following 30 days and create a few goals there to get you to the end of 60 days. Finally, think what you’d like to do for the remaining 30 days of the quarter (finishing out your 90 days).

By using this method and checking in on it once a week, you’ll likely find that you’ll accomplish most of the items on your list. And over time, quarter after quarter, you’ll start to notice what a difference this makes in keeping you on track with your money goals. Until next time, enjoy.

Gary

If you’d like to read more on this topic, here are a few of Gary’s previous posts that you might enjoy: