Key Takeaways

- How we take on debt and how we pay it back can be a bit of an intangible concept.

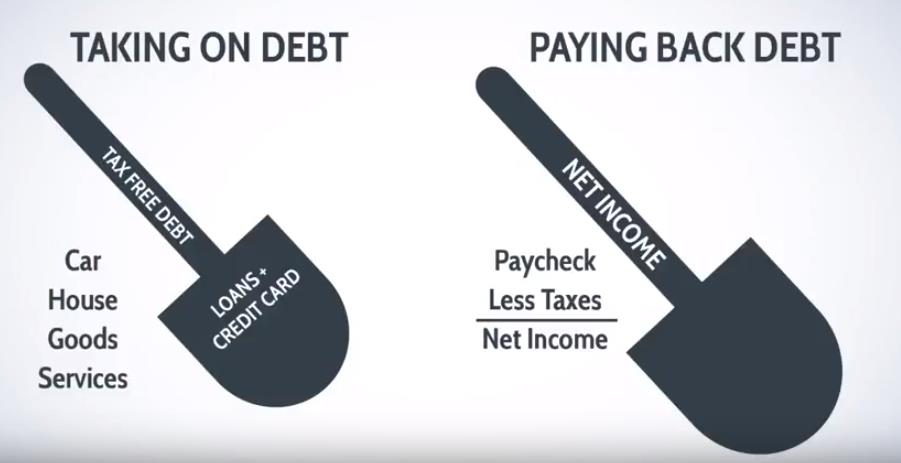

- When you initially take on debt, it’s tax free, but when you pay it back, it’s with money after tax, and that means it takes more of your income to pay that debt back than you originally took out.

- Understanding this concept ahead of taking on any debt will help you plan out what you will need in terms of cash flow to pay that debt back.

You’ve probably seen the movie Elf. Will Ferrell plays the title role of Elf, and Bob Newhart plays Papa Elf. There’s a scene where Elf is sitting on Papa Elf’s lap, and of course, we all know that Will Ferrell is not that much bigger than Bob Newhart, but he looks like he’s crushing Papa Elf. We know they are playing with camera angles to make it look that way. If they’d used a different angle, we’d see their true size. This same analogy can be applied to how we take on debt, and it’s not very understandable up front because it’s a bit of an intangible concept.

I like to use the analogy of a shovel to help explain: When you initially take on debt, it’s tax free, so you are using a small shovel to take this money and do whatever it is you are using it for, like buying a car, a house, or paying for school. However, when you go to pay back the loan, you have to pay it back with money after tax, which means it takes a much bigger shovel. You need a shovel that’s 30-40% larger than the one you started with to end with the same amount of money that you used to take on the initial debt. For example, if you took on $10,000 of debt, you might have to pay $14,000 or $15,000 of income that, after all the taxes, gives you the $10,000 you need to pay off the debt.

It’s very important to understand this concept right up front before you take on any debt, especially with what’s going on with student debt right now. It’s very hard for a lot of people who are trying to pay this off, and they realize too late what it actually takes to pay it off. Recognizing this leverage that is against you, that you’re going to need a bigger shovel to take care of your debt, is important to remember every time you take on any debt. Ensure you keep the end in mind, so you can plan to have the cash flow necessary to pay that debt off in a reasonable period of time.

Until next time, enjoy!

Gary