Key Takeaways

- A recent study found that 75% of young people, parents with children, don’t have life insurance.

- Some of the reasons given for not having life insurance were that they don’t like the process, they have a false sense of security, they prioritize paying off student debt, they are saving for a home, or they don’t comprehend the value of life insurance.

- Nobody likes to buy life insurance, but it’s better to have it for peace of mind, then to not be prepared should the unthinkable happen.

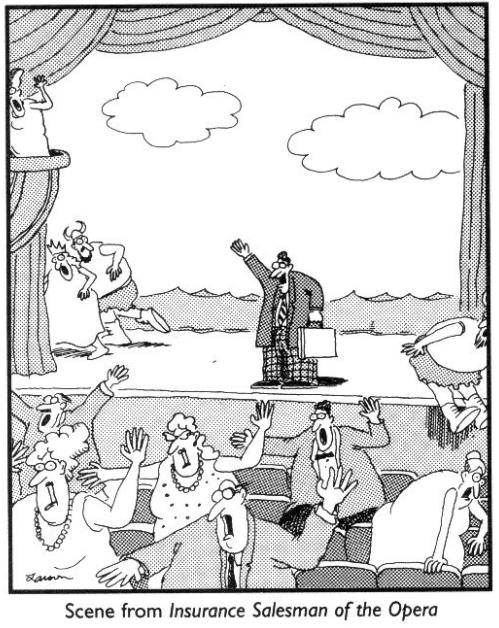

When I started in business, I went out on a sales call, and I was really excited because this guy sounded like he wanted to buy some insurance. But then he laughed in my face and said, “Sonny, I’m insurance poor, what do you think? I’m not paying for any insurance.” It was a blunt lesson to learn that nobody likes insurance!

There was a recent study done by Bestow, an online insurance brokerage company, that found 75% of young people, parents with children, don’t have life insurance. They give five reasons for this:

- Don’t like the process. You have to go through the underwriting process, it can be confusing, and it takes some time. Unfortunately, like with other processes, it’s just the way it is until someone, or some technology, comes along and makes it better.

- False sense of security. I’ve seen it where people set up Go Fund Me sites when someone passes away, or they just think money will magically appear, and that’s just not a good plan. Also, when we are young, death seems like such a long way away. We rarely think about the unexpected circumstances.

- Prioritizing paying off student debt. There’s a lot of young people with a lot of student debt that they are trying to pay off, so any extra money is going towards that.

- Saving for a home. If they aren’t paying off student debt, they are saving for a home.

- Don’t comprehend the value of life insurance. A million dollars of coverage if you’re in good health for a 20-year term policy, would set you back about $500-$600 a year. Spread that amount over the year, and you are looking at $40-$50 a month. That’s not that much when you think about what it would take to come up with a million dollars on your own, on top of dealing with the sudden loss of a loved one.

You have insurance on your house in case there’s a flood, fire or other disaster, and you have insurance for your car in case of an accident. Some of these are mandated by law, for good reason. So why would life insurance be so far-fetched? The probability of your house burning down isn’t really that far apart in the realm of possibility when we talk about accidental death. So, it’s important to make sure you have your bases covered.

Nobody likes to buy insurance. But you have to pay a little to ensure that coverage is there, so you can sleep at night knowing everything will be ok should something happen.

Unfortunately, I’ve had to see at least a dozen people, widows and widowers, over the past 30 years who have not been covered. It’s extremely difficult not having a lump sum of money right when you need it, especially for a young family with things like mortgages to cover and college to save for. It just makes a lot of sense to pay a small cost for peace of mind.

So, think about it. It’s really important when you are starting a family. Yes, it can sometimes be a confusing process, but you’ll get through it, and it’s worth it to ensure your family is taken care of should the unthinkable happen.

Until next time, enjoy!

Gary