Key Takeaways

- Two basic types of trusts are revocable trusts and irrevocable trusts.

- Both are legal documents, and both hold assets and have trustees and beneficiaries.

- There are different reasons people have for choosing revocable versus irrevocable trusts.

Have you ever watched a movie or read a book where a character sells their soul to the devil? They find themselves in a binding situation, with no way out, as soon as they shake hands or sign that contract!

While not nearly as dramatic, when we’re talking about trusts, this type of scene may come to mind when you hear the terms revocable and irrevocable. What’s the difference between these two?

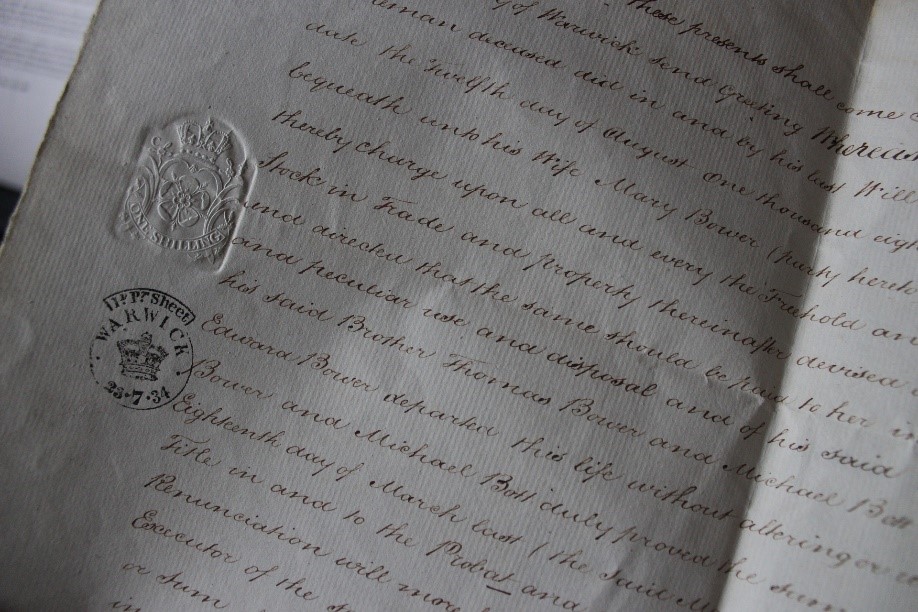

They’re both basic types of trusts based on common law that came over with the settlers from Great Britain – so they’ve been around for a long time. They’re legal documents that are set up to hold title to assets. Named trustee(s) control the decision making and management of the assets held in the name of the trust.

With revocable trusts, the IRS and the legal world view it as just an extension of you. It owns assets and can dictate what happens if you become incapacitated or pass away – where the money would go, who would control it, and so forth. You can change it at any time, you can get rid of it if you no longer want the trust, and you basically have complete control over it because it’s revocable.

When it comes to irrevocable trusts, you cannot undo them. Once an irrevocable trust is created, it’s as if it’s written in stone. The trustee follows what the trust says; if the trustee passes away, there are successor trustees, which could be named people, banks, or financial institutions. The trust can continue for a long period of time, but it’s irrevocable, so its terms cannot be changed. If you didn’t set it up correctly, there’s not much you can do about it, so you want to be certain about the terms when you create an irrevocable trust.

Most commonly, irrevocable trusts are created at death. This is because people want to lock things in to be done a certain way once they’re gone. For instance, they may want to ensure their assets go to their spouse and then to their children, not to someone new who might come into the picture down the road.

Deciding when to create a trust and what type of trust to create is a whole other subject for another time. Hopefully this clears up what revocable and irrevocable trusts are, though. Until next time, enjoy.

Gary

If you’d like to read more on this topic, here are a few of Gary’s previous posts that you might enjoy: