Key Takeaways

- Do a quick, three minute look at your finances every Friday to ensure there are no irregularities and to keep your budget on track.

- One Friday every month, look at your assets and liabilities to ensure you are on track for any financial goals you might have.

- Once a year, do long-term planning to ensure you can save up the money you want, save for big expenses or things like vacations and other things you might want to do.

A friend of mine, Ari Meisel, mentioned to me that he looks at his finances every Friday. I said, “Oh, Financial Fridays, that’s really cool!” I think that makes a lot of sense.

Not that long ago, people used to go through the tedious process of balancing their checkbooks once a month. Today, it’s all on-the-go financing. You can check your finances any time you want now, but looking at your finances on a weekly basis is a great idea. So, let’s talk Financial Fridays!

On Fridays, you only need about three minutes to look over your finances, but what are you looking for?

- Last week of transactions – Look over everything that happened with your checking account, savings, credit cards, debit cards, and check to ensure there are no irregularities or suspicious purchases or transactions.

- Check your budget – are you on track with your income versus expenses for the month? Is your spending on target to ensure you aren’t going to go over your budget?

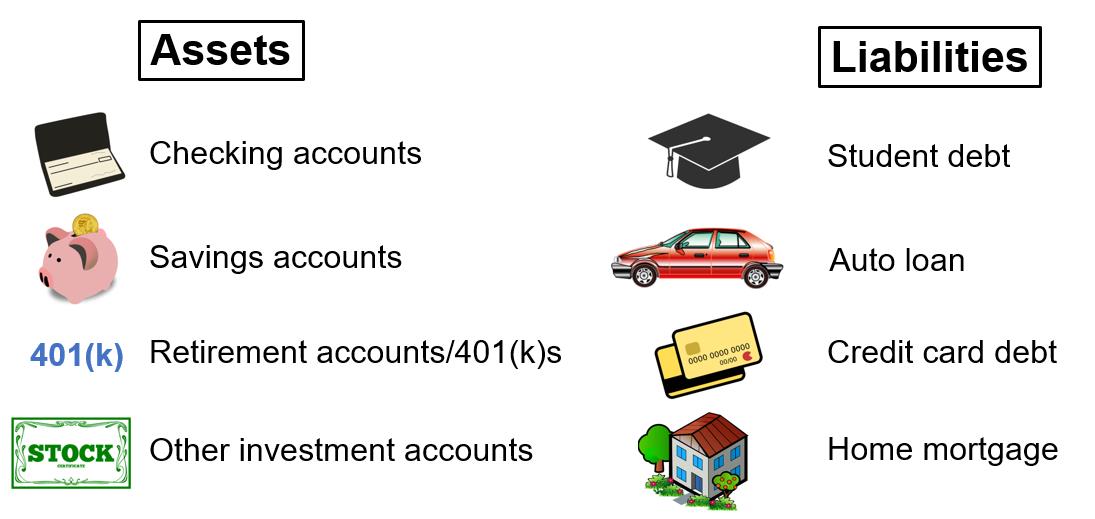

One Friday a month, you want to look over your assets and liabilities. Your assets would be things like 401(k)s, savings and checking accounts, and investment accounts. Your liabilities are things like student debt, auto loans, credit card debt, and home mortgages. You want to look over these things to see where you are in terms of things like savings goals you might have, or perhaps debt repayment goals. It allows you a chance to either see that things are moving along smoothly, or show you that you may need to refocus on something to meet a goal you have.

Then, once a year, for about an hour, you want to do some planning for the next year. This would cover:

- How much do you want to save for the next year?

- What events like vacations, weddings, or other big events do you need to save up for?

- What big purchases do you know you have coming up, such as the down payment on a house, new furniture, or other large ticket item?

The goal is to do some long-term planning to ensure you have the money you need for the things you want to do during the next year.

Today, you can go out there and find some great apps and websites that help you do all this in one place. Not every website covers all three of these short, medium, and long-term financial checks, but some do. We have a wealth portal where you can see absolutely everything in one place, and we love working with it.

So just remember, take a couple of minutes every week to check your finances to make sure everything is on track for your own personal financial goals.

Until next time, enjoy!