Key Takeaways

- If you get a raise or your income increases for some reason, use the 50% Rule to take half of that increased income and save it or pay down debt.

- Many times when we have an increase in income, we spend it on things we don’t really need. That new increase in money very quickly gets spent away when it could be used to help in other areas.

- Even if the money you are saving or paying down debt with doesn’t seem like a lot, it can make a big difference in the long run.

When I was a kid, once in a while, I’d come home with a test score that was really low, like 50%, and of course, my parents were not happy! However, if you apply 50% to the real world, it’s a much different result.

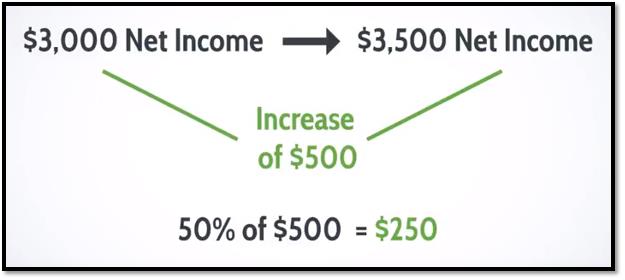

I get asked a lot, “How do I save more money or pay down more debt?” The answer I give is to use the 50% Rule. What does that mean? The next time you get a pay raise, take half of it and save it or pay down debt, or both. For instance, if you were taking home $3,000 a month of net income, and then you get a raise and you now take home $3,500 a month of net income, take $250 of that and save it or pay down debt.

The problem with getting pay raises or other increases in total income, is we tend to spend that extra money that we haven’t been used to having on frivolous things, and we end up wondering where all the money goes. If you hold yourself to the 50% rule right off the bat, you won’t get used to having that extra money and using it for things you don’t really need.

It’s important to remember that each time you get a raise, or your income increases for some reason, to ensure you take 50% of that net amount and set it aside. It might not be a lot of extra money, but using the 50% rule can make a big difference in the long run for paying down debt or accumulating savings. You’ll really be growing your wealth successfully much more quickly over time.

Until next time, enjoy!

Gary