Financial Stress

Key Takeaways A recent study by the National Endowment for Financial Education revealed that the pandemic is causing many Americans to experience financial stress. Worries

Key Takeaways A recent study by the National Endowment for Financial Education revealed that the pandemic is causing many Americans to experience financial stress. Worries

Key Takeaways Though we don’t have the ability to look into the future, we can benefit from thinking about our future selves. The next best

Key takeaways Warren Buffett says the two things he values most are time and love. Each of us has the same 24 hours in a

Key Takeaways As humans, we sometimes find ourselves in situations where our emotions run wild and stress gets the better of us. Brad Waters wrote

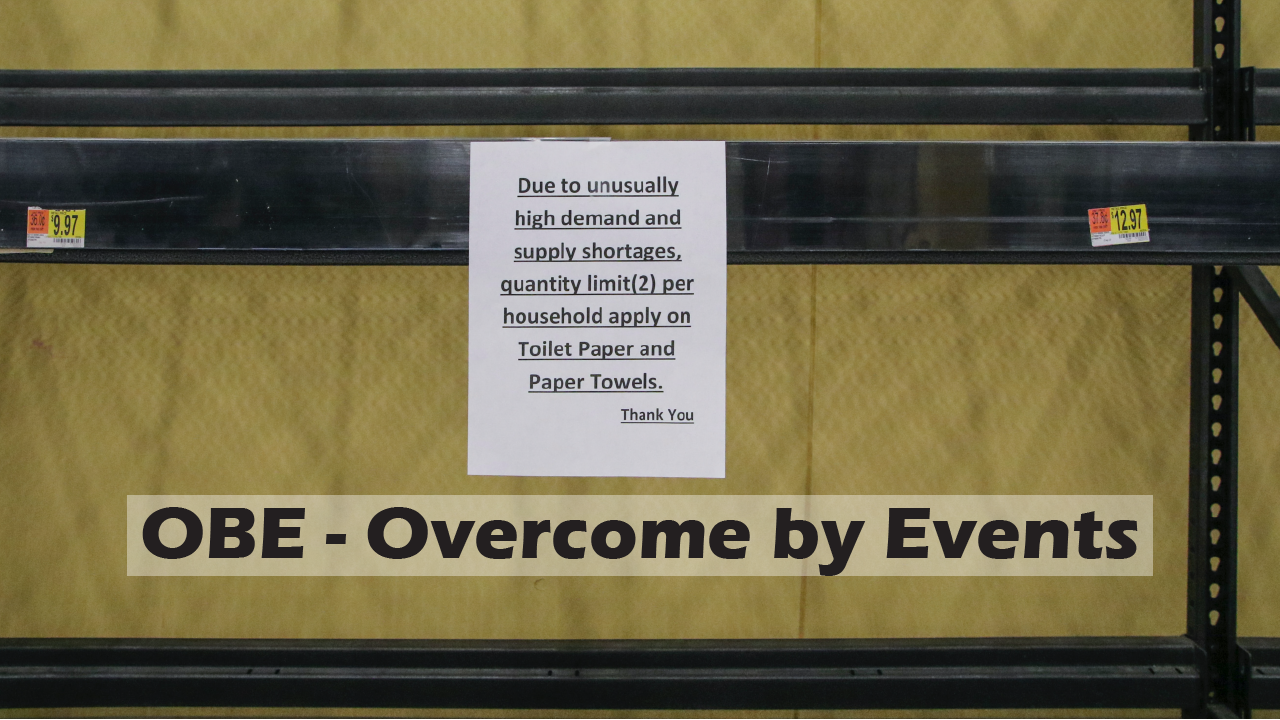

We’re dealing with three issues right now; unexpectedness, shock, and disruptiveness. If we look at this situation from the standpoint of

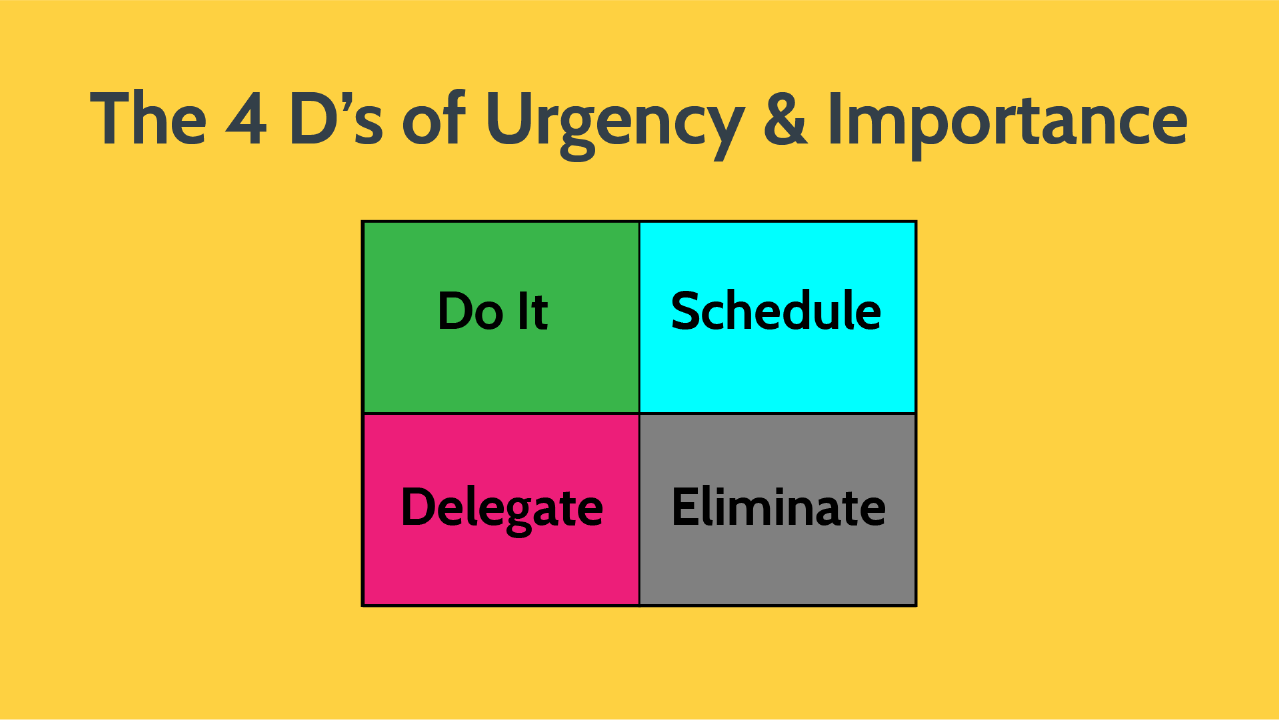

Key Takeaways We fill our lives with a mixture of things that range in their levels of importance. If we spend too much time on

Idle hands are the devil’s workshop, we don’t want to go there, and that’s something that we’re dealing with a lot of the time right

Mann Tracht, Un Gott lacht is an old Yiddish adage that means; man plans and God laughs. Isn’t that true? The modern day version of

There may be a lot of change coming to the travel industry due to closer personal and increased global connectivity. How will this affect

We have changed the way we’ve done things over the last month or so, one of them is how we shop for groceries. As we